Lease Option Brochure

When and How to use it

When you have a client that doesn’t qualify for a mortgage, but they meet the requirements for our Lease Option Program, use this brochure to help introduce them to the opportunity

Present the brochure to your client giving them the disappointing news that they aren’t approved for a mortgage. Assumably you would be giving them pointers on how to get approved anyway, just quickly write it down in the summery section of the brochure to seamlessly introduction the opportunity to them. Further down this page are some examples of how you can fill out the brochure in the most meaningful way.

This personalized brochure gives them an idea what factors their Lease Option Program will be structured around and the benefits of joining. If they can accomplish the steps you’ve laid out in 4 years or less, and getting out of a rental is a priority, then the program is a great alternative!

When your client wants to be considered for the program, let us know by submitting them as a qualified Tenant Buyer. First, have your client sign the disclosure form below, then you submit it to us online along with the rest of their details!

Submit a Qualified Tenant Buyer

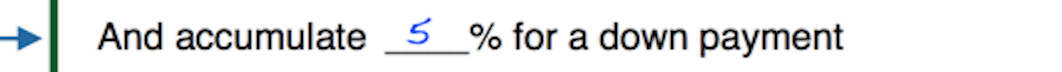

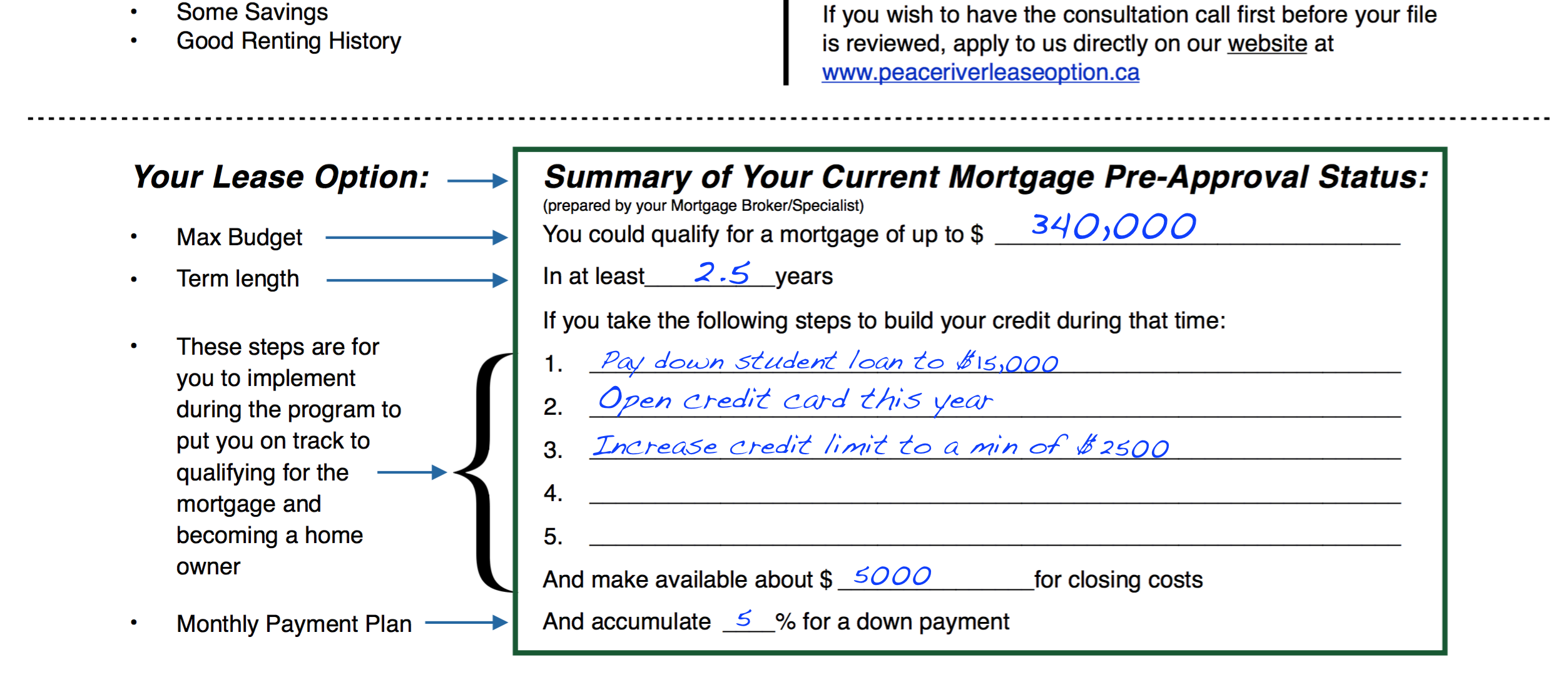

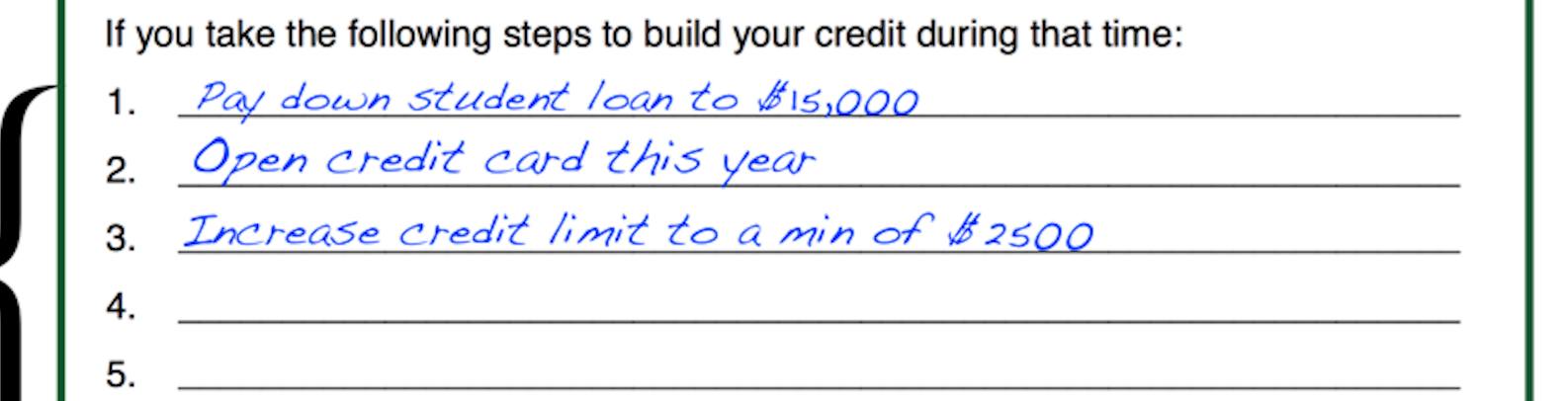

Here are some examples of how to completed the summery section of the brochure.

Example 1

Example 2

Filling in the brochure:

- The first line is the maximum mortgage they could qualify for in the next 1-4 years based in their current income, and the recommendations you give in the third section.

Our practice is to qualify them at an interest rate that is 1-2% higher than the current qualifying rate to hedge against an increase in interest rates.

- Line two is the minimum amount of time they will need for any larger credit problems to fall off their credit history. If there is simply a lack of credit, it can be the minimum amount of good credit history they are required to have.

If their credit is not an issue, you can leave it zero and the minimum Lease Option Term will be determined solely by how much time they will need to build a downpayment.

- The third section is for you to list any extra items they will need to do in order to qualify for their mortgage. Steps for building credit i.e. getting credit cards, opening lines of credit, increasing limits, paying off collections, making no late payments if that has been an issue, etc.

Also, detail debts that need to be paid down or income that needs to be claimed and anything else necessary for the situation.

- The second last line is the closing costs the client needs to prepare for when they get their mortgage. Costs are standard closing costs, legal, property tax, inspection/appraisal, and land transfer tax if applicable.

- The final line is the minimum downpayment that will be required, often it will be 5%. But 10% may be require by some lenders in certain situations, like if the client is self employed or has had a bankruptcy or consumer proposal.

The downpayment is accumulated as part of the Lease Option Program, usually we aim to have some extra downpayment available (6-7% or 10-12% respectively) as in our experience lenders are more favourable about giving the client a mortgage that way.